I now have four long tips (Morgan Sindall, Airtel Africa, J Sainsbury and National Express) as well as six shorts (Teladoc, HubSpot, AMC, KE Holdings, DWAC and Coinbase).

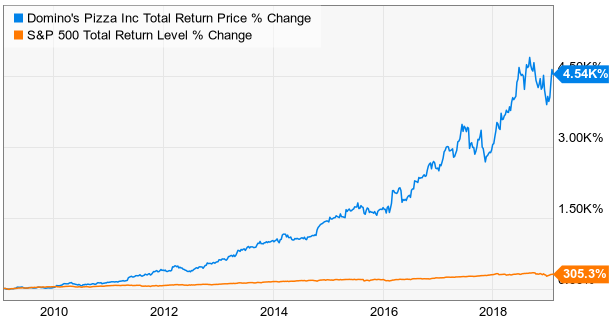

#DOMINOS STOCK PRICE UPDATE#

This means that my short and long tips are making combined profits of £7,962, up from £7,011 at my last update at the end of March.

Overall, my six short tips are now making net profits of £5,312. Digital currency exchange Coinbase fell from $177 to $121. Remote medicine stock Teladoc slumped from $65.55 to $35.73, and DWAC, the company behind Donald Trump’s social-media “empire” slipped from $68.91 to $47.91. Cinema chain AMC declined from $15.86 to $15.26 and marketing software group HubSpot fell from $459 to $380. The good news is that five out of my six short tips have also declined in value. Overall, my four long tips are making a net profit of £2,650, down from £3,423. The only exception is National Express, which rose in value from 230p to 251p. Online retailer Asos is now at 1,418p, well below the price of 1,800p at which I said you should go long. Construction firm Morgan Sindall has fallen from 2,431p to 2,155p, supermarket J Sainsbury has declined from 259p to 237p and Airtel Africa dipped from 152p to 146p. Over the past six weeks, my four long tips haven’t done very well, with three out of the four positions falling in price. Instead, I’d wait until they reach 375p before pulling the trigger, then I’d go long at £7.50 per 1p with a stop loss of 240p. Given that Dominos’s shares are currently slightly below both their 50-day and 200-day moving averages, I wouldn’t immediate go long. Despite all this it still trades at a modest 16 times forecast 2023 earnings with a dividend yield of 3%. Lastly, it is also putting more cash into growing its German venture, which has already seen success. The firm is also responding to changing trends by expanding the range of pizzas on offer, especially in terms of vegan and vegetarian options.

0 kommentar(er)

0 kommentar(er)